Gst Rate For Flat Purchase . Gst is also chargeable on the supply of. Let’s explore the beneficial impacts of gst on the real estate market, highlight the current. The sale and lease of properties in singapore are subject to gst except for residential properties. This comprehensive guide delves into the intricacies of gst rates applied to flat purchases as of 2024. In this section, we'll explain how gst rates on flat purchases in 2023, gst on residential property, and gst on house purchases can influence. The current gst rate in singapore is 9%. The gst rate has increased from 7% to 8% on 1 january 2023 (“first rate change”) and will further increase from 8% to 9% on 1 january.

from mungfali.com

The sale and lease of properties in singapore are subject to gst except for residential properties. Gst is also chargeable on the supply of. Let’s explore the beneficial impacts of gst on the real estate market, highlight the current. This comprehensive guide delves into the intricacies of gst rates applied to flat purchases as of 2024. The current gst rate in singapore is 9%. In this section, we'll explain how gst rates on flat purchases in 2023, gst on residential property, and gst on house purchases can influence. The gst rate has increased from 7% to 8% on 1 january 2023 (“first rate change”) and will further increase from 8% to 9% on 1 january.

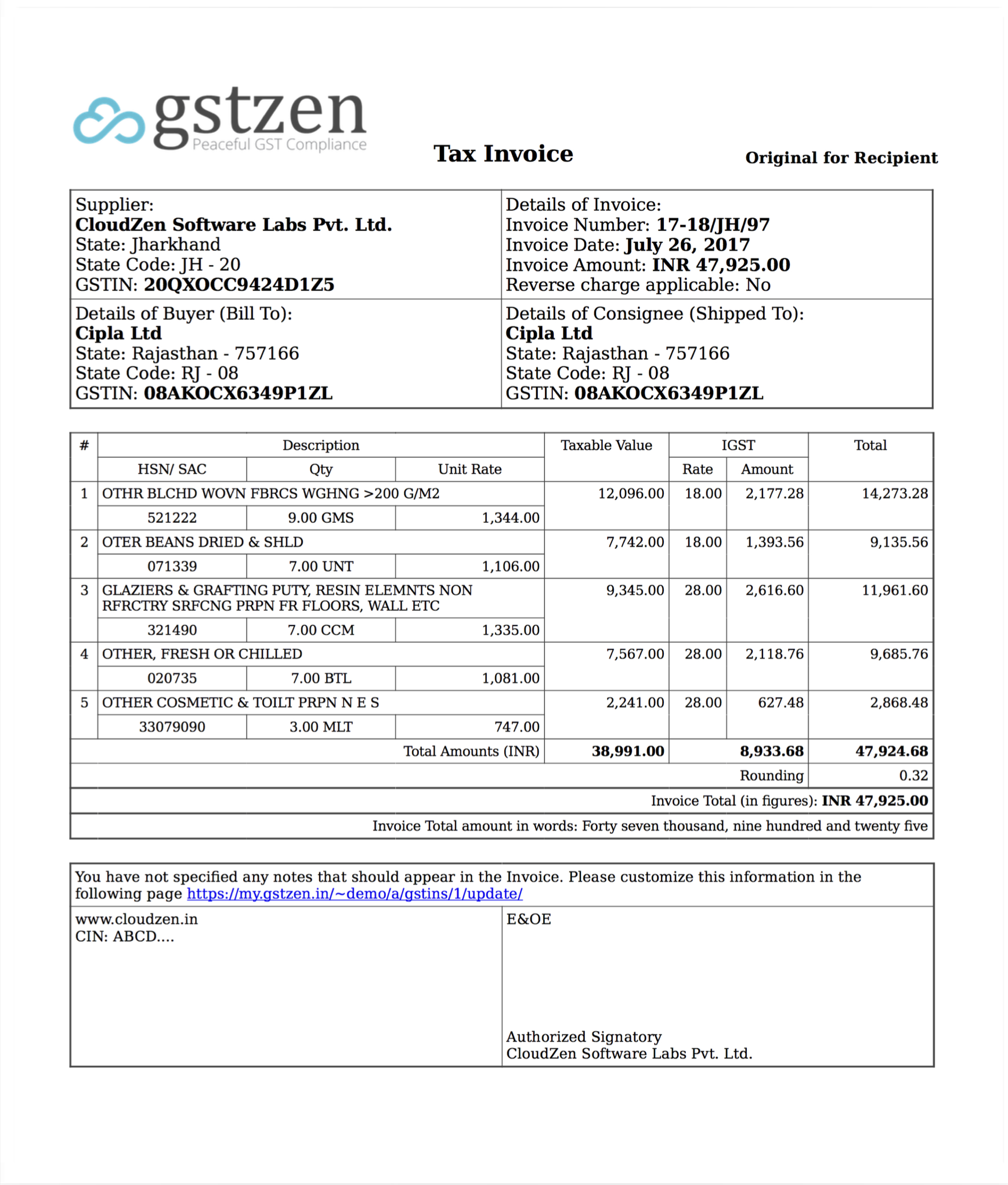

Sample GST Invoice Format

Gst Rate For Flat Purchase The gst rate has increased from 7% to 8% on 1 january 2023 (“first rate change”) and will further increase from 8% to 9% on 1 january. Gst is also chargeable on the supply of. The gst rate has increased from 7% to 8% on 1 january 2023 (“first rate change”) and will further increase from 8% to 9% on 1 january. In this section, we'll explain how gst rates on flat purchases in 2023, gst on residential property, and gst on house purchases can influence. Let’s explore the beneficial impacts of gst on the real estate market, highlight the current. The sale and lease of properties in singapore are subject to gst except for residential properties. The current gst rate in singapore is 9%. This comprehensive guide delves into the intricacies of gst rates applied to flat purchases as of 2024.

From medium.com

GST in real estate 2023 Gst Rates on Flat Purchase by Realtechnirman Gst Rate For Flat Purchase The current gst rate in singapore is 9%. Let’s explore the beneficial impacts of gst on the real estate market, highlight the current. Gst is also chargeable on the supply of. This comprehensive guide delves into the intricacies of gst rates applied to flat purchases as of 2024. The gst rate has increased from 7% to 8% on 1 january. Gst Rate For Flat Purchase.

From www.nobroker.in

GST on Flat Purchase Navigating New Rates & Impacts Gst Rate For Flat Purchase The current gst rate in singapore is 9%. In this section, we'll explain how gst rates on flat purchases in 2023, gst on residential property, and gst on house purchases can influence. The sale and lease of properties in singapore are subject to gst except for residential properties. The gst rate has increased from 7% to 8% on 1 january. Gst Rate For Flat Purchase.

From carajput.com

GST Applicability on under Construction Flat Transactions Gst Rate For Flat Purchase In this section, we'll explain how gst rates on flat purchases in 2023, gst on residential property, and gst on house purchases can influence. Gst is also chargeable on the supply of. This comprehensive guide delves into the intricacies of gst rates applied to flat purchases as of 2024. The sale and lease of properties in singapore are subject to. Gst Rate For Flat Purchase.

From economictimes.indiatimes.com

Buying flats can cheaper after Jan, GST Council plans to reduce Gst Rate For Flat Purchase Gst is also chargeable on the supply of. This comprehensive guide delves into the intricacies of gst rates applied to flat purchases as of 2024. The current gst rate in singapore is 9%. The gst rate has increased from 7% to 8% on 1 january 2023 (“first rate change”) and will further increase from 8% to 9% on 1 january.. Gst Rate For Flat Purchase.

From www.youtube.com

How to calculate GST on flat purchase? YouTube Gst Rate For Flat Purchase The current gst rate in singapore is 9%. In this section, we'll explain how gst rates on flat purchases in 2023, gst on residential property, and gst on house purchases can influence. The gst rate has increased from 7% to 8% on 1 january 2023 (“first rate change”) and will further increase from 8% to 9% on 1 january. This. Gst Rate For Flat Purchase.

From www.youtube.com

Applicability of GST on Completed Flats, Building and Complex GST on Gst Rate For Flat Purchase This comprehensive guide delves into the intricacies of gst rates applied to flat purchases as of 2024. The sale and lease of properties in singapore are subject to gst except for residential properties. In this section, we'll explain how gst rates on flat purchases in 2023, gst on residential property, and gst on house purchases can influence. Gst is also. Gst Rate For Flat Purchase.

From msofficegeek.com

Readytouse Fully Automated GST Invoice Template MSOfficeGeek Gst Rate For Flat Purchase The sale and lease of properties in singapore are subject to gst except for residential properties. The current gst rate in singapore is 9%. In this section, we'll explain how gst rates on flat purchases in 2023, gst on residential property, and gst on house purchases can influence. The gst rate has increased from 7% to 8% on 1 january. Gst Rate For Flat Purchase.

From www.testway.in

GST rate on real estate or under construction property purchase Gst Rate For Flat Purchase The current gst rate in singapore is 9%. The gst rate has increased from 7% to 8% on 1 january 2023 (“first rate change”) and will further increase from 8% to 9% on 1 january. In this section, we'll explain how gst rates on flat purchases in 2023, gst on residential property, and gst on house purchases can influence. The. Gst Rate For Flat Purchase.

From www.captainbiz.com

GST Rate Structure Decoding Sales and Purchase Gst Rate For Flat Purchase This comprehensive guide delves into the intricacies of gst rates applied to flat purchases as of 2024. The current gst rate in singapore is 9%. The sale and lease of properties in singapore are subject to gst except for residential properties. The gst rate has increased from 7% to 8% on 1 january 2023 (“first rate change”) and will further. Gst Rate For Flat Purchase.

From housing.com

Revised GST rate on real estate 2024 Gst Rate For Flat Purchase This comprehensive guide delves into the intricacies of gst rates applied to flat purchases as of 2024. In this section, we'll explain how gst rates on flat purchases in 2023, gst on residential property, and gst on house purchases can influence. Gst is also chargeable on the supply of. Let’s explore the beneficial impacts of gst on the real estate. Gst Rate For Flat Purchase.

From www.gmcshahdol.org

Understand and buy > gst rate on purchase of gold > disponibile Gst Rate For Flat Purchase The gst rate has increased from 7% to 8% on 1 january 2023 (“first rate change”) and will further increase from 8% to 9% on 1 january. Gst is also chargeable on the supply of. In this section, we'll explain how gst rates on flat purchases in 2023, gst on residential property, and gst on house purchases can influence. Let’s. Gst Rate For Flat Purchase.

From caknowledge.com

How to Pass Purchase and Sale Entry with GST in Tally Prime Gst Rate For Flat Purchase In this section, we'll explain how gst rates on flat purchases in 2023, gst on residential property, and gst on house purchases can influence. Gst is also chargeable on the supply of. Let’s explore the beneficial impacts of gst on the real estate market, highlight the current. The current gst rate in singapore is 9%. The sale and lease of. Gst Rate For Flat Purchase.

From www.gharjunction.com

Navigating the World of GST on Flat Purchase Gst Rate For Flat Purchase Let’s explore the beneficial impacts of gst on the real estate market, highlight the current. The sale and lease of properties in singapore are subject to gst except for residential properties. The current gst rate in singapore is 9%. The gst rate has increased from 7% to 8% on 1 january 2023 (“first rate change”) and will further increase from. Gst Rate For Flat Purchase.

From www.nobroker.in

GST on Flat Purchase Navigating New Rates & Impacts Gst Rate For Flat Purchase Let’s explore the beneficial impacts of gst on the real estate market, highlight the current. The gst rate has increased from 7% to 8% on 1 january 2023 (“first rate change”) and will further increase from 8% to 9% on 1 january. In this section, we'll explain how gst rates on flat purchases in 2023, gst on residential property, and. Gst Rate For Flat Purchase.

From www.sobha.com

GST on Real Estate & Flat Purchase SOBHA Ltd. Gst Rate For Flat Purchase In this section, we'll explain how gst rates on flat purchases in 2023, gst on residential property, and gst on house purchases can influence. The gst rate has increased from 7% to 8% on 1 january 2023 (“first rate change”) and will further increase from 8% to 9% on 1 january. This comprehensive guide delves into the intricacies of gst. Gst Rate For Flat Purchase.

From techguruplus.com

GST Invoice Format in Excel, Word, PDF and JPEG (Format No. 20) Gst Rate For Flat Purchase Let’s explore the beneficial impacts of gst on the real estate market, highlight the current. The gst rate has increased from 7% to 8% on 1 january 2023 (“first rate change”) and will further increase from 8% to 9% on 1 january. The sale and lease of properties in singapore are subject to gst except for residential properties. In this. Gst Rate For Flat Purchase.

From www.youtube.com

multiple gst rate entry in tally prime purchase entry with multiple Gst Rate For Flat Purchase Let’s explore the beneficial impacts of gst on the real estate market, highlight the current. Gst is also chargeable on the supply of. In this section, we'll explain how gst rates on flat purchases in 2023, gst on residential property, and gst on house purchases can influence. This comprehensive guide delves into the intricacies of gst rates applied to flat. Gst Rate For Flat Purchase.

From www.youtube.com

[SOLVED] HOW TO AVOID GST ON FLAT PURCHASE? YouTube Gst Rate For Flat Purchase The sale and lease of properties in singapore are subject to gst except for residential properties. Gst is also chargeable on the supply of. Let’s explore the beneficial impacts of gst on the real estate market, highlight the current. The gst rate has increased from 7% to 8% on 1 january 2023 (“first rate change”) and will further increase from. Gst Rate For Flat Purchase.